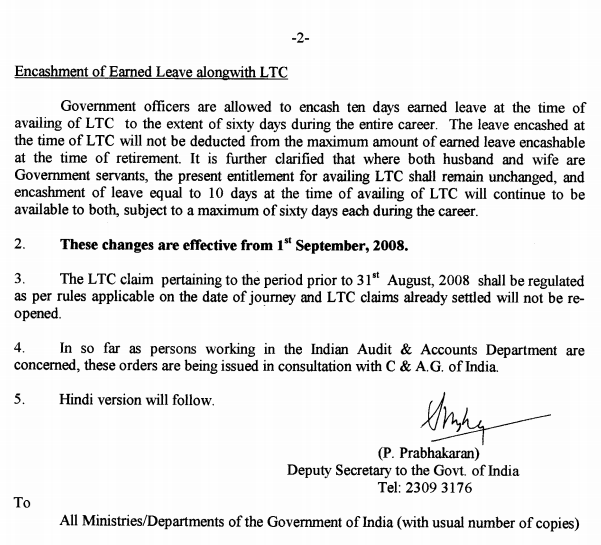

Encashment of earned leave at the time of retirement

Leave encashment non taxable | Income Tax Calculations

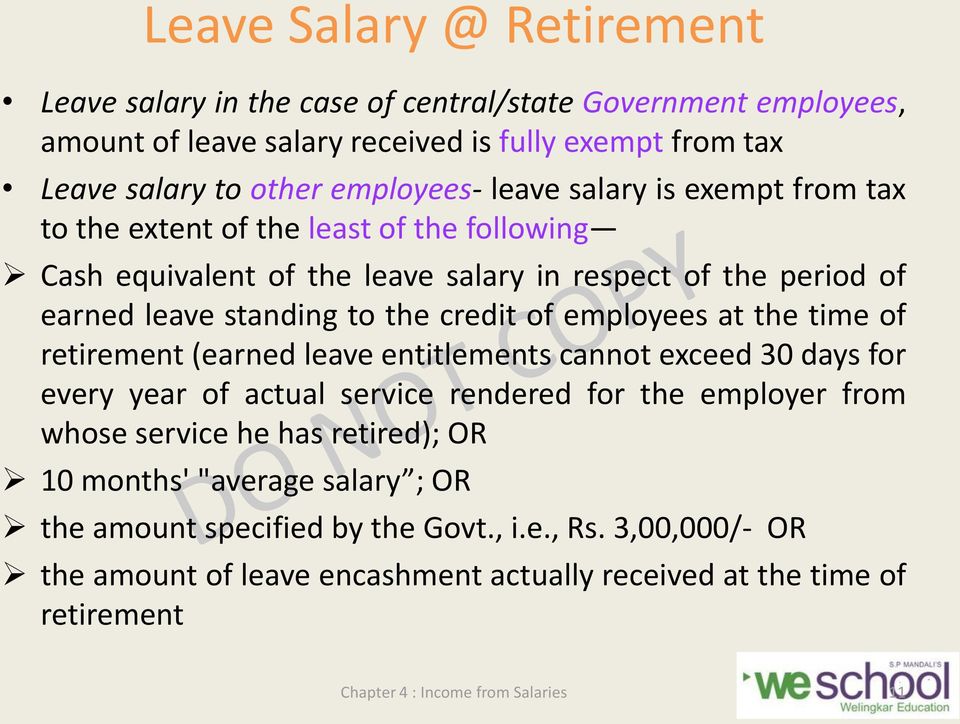

Normally every employee is entitled to certain no. Leave salary received by any employee during the period of service is fully Taxable.

Tax Treatment of Leave Encashment Salary

However relief can be claimed under section Leave salary given to Non-Government employee, the PSU banks employee and other PSU sector employees comes under this category and in their cases least of following will be exempted under section 10 10AA ii.

Here, salary, for this purpose, means basic salary and includes dearness Allowance if terms of employment so provide. It also includes commission based upon fixed percentage of turnover achieved by an employee, if any.

Leave Encashment: Calculation & Taxation

The PSU Banks and other organisations includes the basic components of the Special Allowance, Fixed Pay and Professional Qualification Allowance which are included in their superannuaton benefits i. The following table shows the ceiling of amount exempt from Income Tax revised from time to time. Sign in Register Utilities?

Home Income-Tax Bankers Letter Creator PPF Bank Holiday Investment Widgets Health Learning Misc. New TaxCalculator FY Birthday, Anniversary, Congrats, Good Morning, Thanks, Sorry, Get Well Soon, All The Best, Happy Journey.

Income Tax Calculator PPF Calculator Bankers DA Calculator Save Rax upto Rs. Most Visited Webpages 1. All In One - Multiple Utilities.

Employees 1 Enter Leave Encashment Amount Paid. For the purpose to calculate of exemption of amount of leave encashment enter last 10 months salary S. Month Basic Pay DA Spl Pay Fixed Pay Professional Qualification Pay Total 1 2 3 4 5 6 7 8 9 10 Reset Submit.