Pros and cons of diversification strategy

On returning to Sri Lanka after a decade or so, I found myself struggling to identify the core business activities of some leading local firms that I knew. They have moved away from their principal activities and diversified into businesses lines that they would not have ventured into back then. What has changed over the years puzzled me and I was keen to find what propelled them to engage in new businesses to create a portfolio. I asked myself, was it genius or the unavailing of new discovered opportunities for entrepreneurs or that they have abundant cashable currency that they wish to put to good use?

I looked for answers by exploring the fundamentals of diversification to identify the shift in corporate Sri Lanka. Often companies diversify for a host of good reasons. In other cases, it becomes a survival strategy when single product or service strategy reaches the limits of revenue generation.

To achieve genuine success from planned diversification firms must reinforce internal development; pursue value-chain acquisitions, form strategic alliances and joint ventures. Often you will find that each route has its own set of issues like benefits and limitations.

However, diversification must be driven by 1 opportunities afforded in the business environment, 2 in possession of right resources and 3 own the right skills sets to make structural adjustments to extend the range of goods or services to your exising customers or new markets. By extending your portfolio of products or services, you can ensure new regular revenue streams to boost growth prospects.

In theory, the two principal objectives governing diversification are a to improve core process execution and b enhance a business unit's structural position by creating additional value through synergetic integration of new businesses into the existing ones.

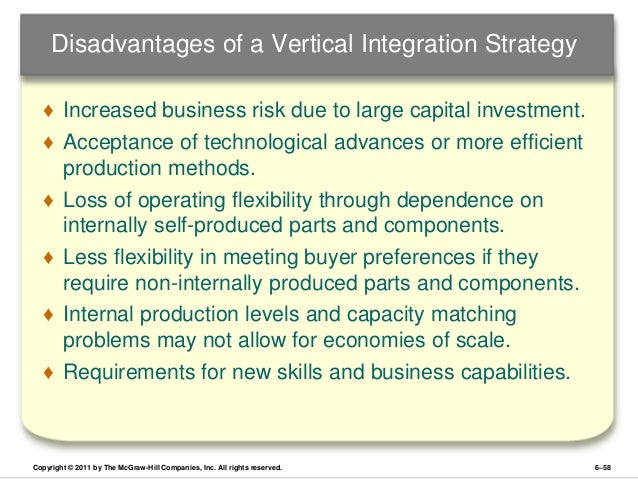

These approaches grant a firm to improve its competitive advantage and thereby, increasing the value for owners. Diversification typically takes one of three forms: Vertical Integration — integrating business along the value chain, both upstream and downstream, so that one efficiently feeds the other.

Horizontal Diversification — moving into more than one industry or new industry relates to the existing ones or pursue a strategy of unrelated diversification. Geographical Diversification — open up new markets, moving into new geographical area to overcome limited growth opportunities in the local market.

Advantages and Disadvantages of Diversification | Diversification (Finance) | Mergers And Acquisitions

When to diversify When to diversify has significance in business decision-making. It is about timing - until the core business is stable enough and the right business environment omnipresent for profit making. The catalyst is the knack for visioning and grasping the opportunity when presented to move away from unprofitable businesses and has limited scope in particular market.

Diversification strategy Diversification strategies are used to expand firms' operations by adding markets, products, services, or stages of production to the existing business. The purpose of diversification is to allow the company to enter lines of business that are different from current operations.

When the new venture is strategically related to the existing lines of business, it is called concentric diversification. Conglomerate diversification occurs when there is no common thread of strategic fit or relationship between the new and old lines of business; the new and old businesses are unrelated.

Some believe that diversification is by natural progression, i. Those extensions represent excellent opportunities for diversification. To strengthen diversification, a new strategic business unit must be capable of transforming and benefiting from the existing core competence to make it difficult for competition to replicate.

Another popular business diversification strategy is called forward and backwards integration acquisition of operations in the supply chain for opportunities to strengthen a firms grip on the market.

When expanding a brand into new markets there is a real danger that it will have no resonance with the newly targeted customers.

Thus, it is vital to conduct extensive research on new markets to determine the sustainability before diversifying. More often, firms in a rush to jump ahead of the competition fail to look in the mirror ask if they are really ready and if the existing business is healthy enough to support the diversification. Do they have the right managers to runescape high alch make money and cope with a diverging strategy?

Should they integrate the diversified business alpari forex factory one company or branch off as a new pros and cons of diversification strategy operation? Once those decisions are made to plunge to diversify, they need to remain for the duration.

Digital Advertising Agency – Marketing Strategy | IQ Agency

If not, what will be exposed is their poor decision-making skills and also raises serious questions about their judgments on all matters. Here is the axiom that corporate big wigs ought to follow - think hard before you jump!

Diversification in the context of growth strategies Diversification is solely a growth strategy and it should not be driven by egoistic compulsion to match what your competitors are engaged in.

Growth strategies should be based on right vision and the capacity to mobilize resources to overcome all adversities venturing into the unknown. Even if profits remain stable or decline, an increase in sales satisfies many people even though the profits are down. The assumption is often made that if sales increase, profits will eventually follow — not so. The golden rule for timed-diversification is when a firm has acquired lower production know-how; labour efficiency; redesign of products or production processes e lower costs and with the right mix of what they are capable of and meeting consumer satisfaction.

Strategy and management teams Rewards for managers are usually greater when a firm is pursuing a growth strategy since it is profit-driven. The higher the sales level, the larger the compensation received. As a result, managers tend to pursue risks that would bring the highest rewards for them, but may not necessarily be the right strategies for companies.

Often it is hard to say whether a firm's diversification strategy is well matched by the strengths of its top management factoring their past successes. For example, the success of pros and cons of diversification strategy diversification will depend not only on how well integrated are the key factors, but also on how well suited are top executives are to manage that effort and guide through rough times.

Studies also non deposit forex bonus 2013 that different diversification strategies require different sets of skills within a firm, not relying on the same company managers.

To be successful, a firm must invest in acquiring the right skills, if not at least provide the opportunities to enhance those critical skills to within. The days of jack-of-all-trades are gone, specialization have become that significant today to insure that corporate goals are achieved with minimum losses. In Sri Lanka, there are many solid reasons for pursuing a diversification strategy, the war has ended and new opportunities are abundant. They could expand by developing new business or by buying ongoing businesses.

Without a question, most will be drive by management's desire for profit making, yet that must be preceded by an internal assessment to determine their fitness to diversify. If the answers to all the questions posed here are positive, then corporate Sri Lanka's strategic business diversification is in the right direction and Sri Lankan business enterprising is destined to prosper.

Reproduction of articles permitted when used without any alterations to contents and a link to the source page. Site best viewed in IE ver 6. By Ravi Randeniya BScEng MScE MBA Former Senior Policy Analyst, Ministry of Trade and Economic Development Govt of British Columbia, Canada. Vertical Integration — integrating business along the value chain, both upstream and downstream, so that one efficiently feeds the other, Horizontal Diversification — moving into more than one industry or new industry relates to the existing ones or pursue a strategy of unrelated diversification, Geographical Diversification — open up new markets, moving into new geographical area to overcome limited growth opportunities in the local market.

Other Business Times Articles. Lankan stocks should be more pricey. Softlogic raises Rs 1 bln through private placement. Feature - Fashionably late?

Feature - Risk Management in Modern Banking — Defending the cash line.

Feature - Strategic business diversification. Comment - Diversifying a business. Young bankers lack basic skills - top industry official. Nenasa TV expands coverage to schools. CB reaffirms Sri Lanka's strong financial stability.

Aitken Spence Hotels to raise Rs 2. Knowledge worker discussion at Sunday Times Business Club. SL CEO's focus is on getting more from same costs.

12 Diversification Strategy Pros and Cons | nihoyuyipe.web.fc2.com

SL must work harder to attract Japanese - Ambassador. Softlogic wins gold for corporate accountability. Northern Governor helps to revive private sector in Kilinochchi.

Foreign investment interest rises in upbeat tourism. Private sector must push parliament to approve urban developments — Minister. Global companies fail to capitalise on talented women. Wake-up call on corporate criminal liability. Better profits from Aitken Spence local, Maldivian resorts -Fitch. SLASSCOM plans IT business incubator by end Plastics have real value though perceived as environmental hazard. Chilaw Finance Ltd celebrates 30th anniversary.

Amana wins top global award for Islamic Finance in Sri Lanka. Domestic shoe makers urge government to cut taxes on components. Lankaclear to provide Central Bank cash management services in Anuradhapura. Pitch it like what tea and cricket are to Sri Lanka.

President needs to get involved. Sri Lanka chosen by Emirates for exclusive UK tours catalogue. Make it happen, not expect it to happen.