Stochrsi trading strategy

Vix FIX / StochRSI Strategy — trading strategy by timj / | TradingView

I take a top-down approach to trend following. Identifying the direction of the broad market is the main objective.

My primary indicator, my unemotional compass is J. RSI is measured on a scale of 0 to with, traditionally, a 14 period of measure. Wilder considered RSI overbought above 70 and oversold below In my work, I use 50 as my line in the sand.

Over 50, the trend is positive, below 50, negative. For the period setting, I use a weekly 14 instead of the more common daily My goal is to identify an intermediate trend and ride it for weeks and months.

Pretty nice run, huh?

Investing through the years of the tech wreck and the financial crisis has tempered my risk tolerance. Could we have enhanced our returns and limited our down side?

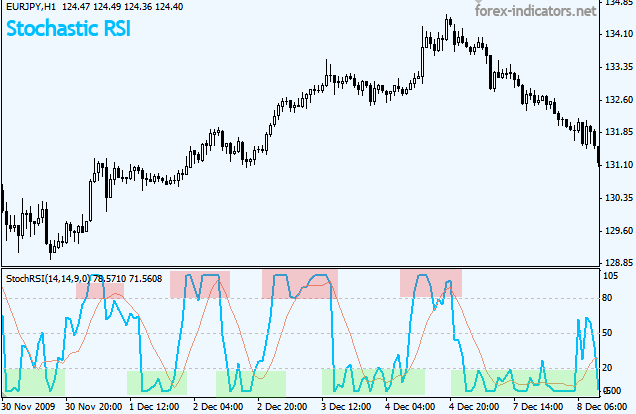

StochRSI was developed in by Tushard Chande and Stanley Kroll and illustrated in the book The New Technical Trader. They believed they could increase the sensitivity of RSI by applying a stochastic formula to it, thereby creating a momentum oscillator that is an indicator of an indicator. StochRSI measures the level of RSI, not the level of the underlying security.

It is more volatile than RSI and generates quicker signals. Once again, I attempt to keep it relatively simple. When the StochRSI has fallen below.

Conversely, when the indicator crosses above. As seen in Figure 1, we get whipsawed quickly. The StochRSI fell below.

StochRSI [ChartSchool]

We liquidate our SPXU and wait for the next signal. We quickly get a drop below. Not only did we enhance our returns, but we were able to hedge our down side and identify re-entry levels quicker than just using the RSI.

Episode 54: StochRSI Stochastics applied to Relative Strength Index valuesStochRSI, like so many technical indicators, can be formatted to suit your specific timeframes and objectives. Study it, back test it and even trade a little with it. You might be able to add a little simplicity to your investing regimen. I work with individuals on asset management and the development of personalized trading systems.

Hughes Optioneering

Spent twenty years as a registered rep in the financial services industry. Believe that technical analysis trumps useless noise. Looking to catch intermediate and long term trends. Utilize weekly charts focusing on RSI, StochRSI and moving averages.

Keep it simple and pay it forward. Enhance Returns With StochRSI Author: BobConklin March 27, Thank you for introducing this indicator. Many people use the RSI but a little different. A cross above the 50 zone is long and cross below the 50 zone is short. Now combine that with your stochRSI signals and it is pretty spot on! I will take a harder look at them together I've used RSI and stochastics. But, never knew about StochRSI, thanks for the education.

Thanks for the feedback. A nervous, first-time contributor Sign-In to Comment Name: You will also receive a FREE subscription to the E-Newsletters from TraderPlanet. BobConklin Member Since President of Conklin Financial Services, Inc.

More Comments by BobConklin. Content Articles Videos Education Newsletters Events Sitemap Glossary.