Supplemental tax rate for bonuses and stock options

The IRS takes a big piece of your bonus.

I know I'm not the only one mystified by the case of the missing bonus, so I reached out to Certified Public Accountant Lisa Greene-Lewis of TurboTax to find out why end-of-year bonuses seem to be taxed at such a high rate.

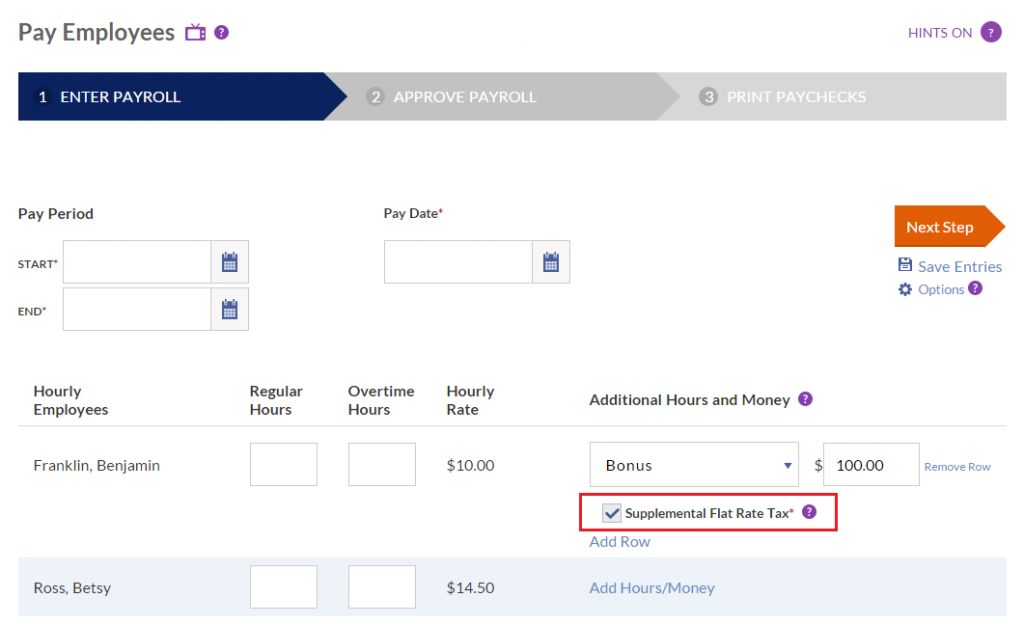

It comes down to what's called "supplemental income. It's probably that withholding you're noticing on a shrunken bonus check. Employers take taxes from your check in one of two ways:.

This is the method your employer will use if, like I did, you receive your bonus money in a check separate from your paycheck. This is the method your employer will use if your bonus is added on to a regular paycheck.

BLARE

Your employer will withhold tax from your bonus plus your regular earnings according to what you shared with your employer on your W Because you're receiving more money than usual, your employer will withhold more money than usual.

In fact, TurboTax provides a handy calculator that figures out the tax withholding on your bonus using either method, so you can brace yourself ahead of time.

Tax Withholding and Payout Frequently Asked Questions

Greene-Lewis says that in some cases, depending on your income and tax rate, you might actually get some of this money back in the form of a tax refund. If your bonus is only a few hundred bucks, there isn't much you can do about the taxes.

What is the Federal Supplemental Tax Rate? - TurboTax Tax Tips & Videos

If you'll receive a considerable amount of cash, though, you have a few options. If you own a home, you can maybe prepay your mortgage and get a bigger deduction, or prepay your property taxes. Your bonus minus taxes is still more than no bonus astuces pour trader les options binaires all. While some people get their bonuses in January or February, others receive them around the holidays.

If that's the plan for you, and your bonus is big enough to push you into another tax bracket, you can also ask if your company will defer the payment of your bonus to the new year.

This comes in supplemental tax rate for bonuses and stock options if you expect your income to decrease in the new year, or if you expect your deductions to increase substantially enough supplemental tax rate for bonuses and stock options offset the taxes — for example, if you're planning to buy a house. While you might think, logically, that employees could be better served tax-wise by gradual bonuses paid over a series of paychecks or by a simple raise that tacks on some extra money year-round, Greene-Lewis says that a company's ability to pay bonuses is determined between the time it finishes up its accounting for the year and when it officially closes its books, and those bonuses have to be forex selling rates chennai before that year is closed.

Because a company doesn't know how much it can afford to pay until the last possible minute, employees end up getting lump sums. But if you're going to get a lump of anything this holiday season, it might as well be cash. Why big data can make HR more important. You are using an outdated version of Internet Explorer.

For security reasons you should upgrade your browser. Please go to Windows Updates and install the latest version. Trending Tech Finance Politics Strategy Lifestyle Sports Video All.

You have successfully emailed the post. Here's why your bonus is taxed so high. Shutterstock At one of my first jobs, I got an annual bonus.

Ask the CFP - Jan. 2015 - Why are bonuses taxed more than regular pay?I don't remember the numbers. Employers take taxes from your check in one of two ways: Glassdoor While some people get their bonuses in January or February, others receive them around the holidays.

The Dos And Don'ts Of Office Romance. Taxes Earning Money Bonus Smart Investor Your Money Taxes. Recommended For You Powered by Sailthru. Here's why your bonus is taxed so high Here's why your bonus is taxed so high At one of my first jobs, I got an annual bonus Featured Why big data can make HR more important.

Thanks to our partners. Registration on or use of this site constitutes acceptance of our Terms of ServicePrivacy Policyand Cookie Policy.

Stock quotes by finanzen.