Kelly criterion for options trading

We often hear about the importance of diversifying, but perhaps it's easier said than done.

How much money do we put in each stock? When do we buy or sell those stocks? These are all questions that can be answered by defining a money management system. Here we look at the Kelly Criterion , one of the many techniques that can be used to manage your money effectively. Soon after the method was published as " A New Interpretation Of Information Rate " , however, the gambling community got wind of it and realized its potential as an optimal betting system in horse racing.

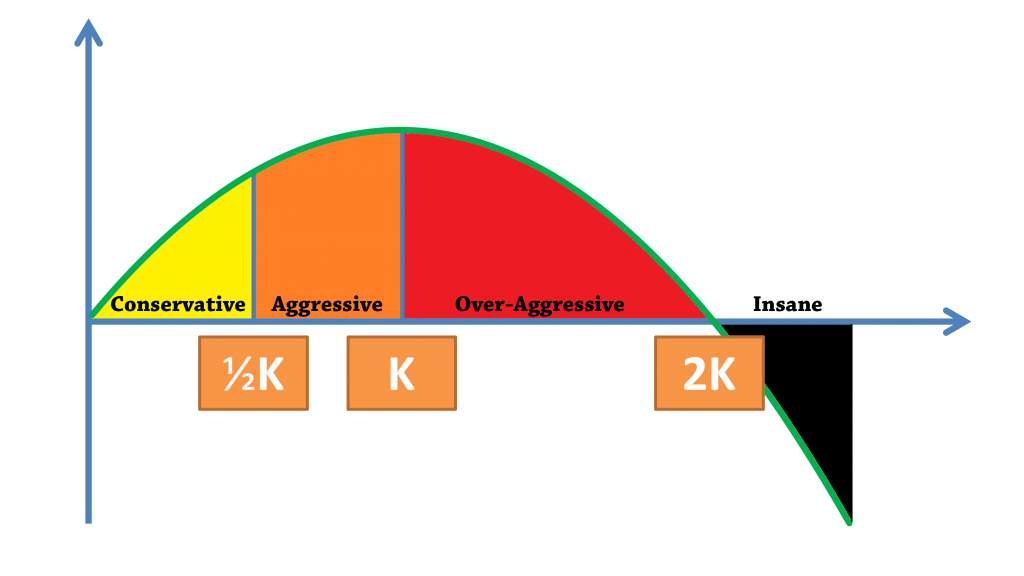

It enabled gamblers to maximize the size of their bankroll over the long term. Today, many people use it as a general money management system for not only gambling but also investing. The Basics There are two basic components to the Kelly Criterion: Putting It to Use Kelly's system can be put to use by following these simple steps:. Interpreting the Results The percentage a number less than one that the equation produces represents the size of the positions you should be taking.

For example, if the Kelly percentage is 0. This system, in essence, lets you know how much you should diversify. The system does require some common sense, however. Allocating any more than this is carries far more risk than most people should be taking. This system is based on pure mathematics. However, some people may question whether this math originally developed for telephones is actually effective in the stock market or gambling arenas.

By showing the simulated growth of a given account based on pure mathematics, an equity chart can demonstrate the effectiveness of this system.

The Kelly Criterion - A Game Changer - Trade with Aram

In other words, the two variables must be entered correctly, and it must be assumed that the investor is able to maintain such performance. Here is an example:. Here we see the activity in 50 simulated trading accounts by means of an equity curve.

The average amount won is the same as the average amount lost. The result is a positive return in the long run for all traders notice some short-term downside, however. Bars represent the time between trades or trading system outputs. Why Isn't Everyone Making Money? No money management system is perfect. This system will help you to diversify your portfolio efficiently, but there are many things that it can't do.

It cannot pick winning stocks for you, make sure you continue to trade consistently or predict sudden market crashes although it can lighten the blow. Also, there is always a certain amount of "luck" or randomness in the markets, which can alter your returns.

Consider again the above chart. Both traders used the same system, but randomness and volatility can cause temporary swings in account value.

The Bottom Line Money management cannot ensure that you always make spectacular returns, but it can help you limit your losses and maximize your gains through efficient diversification.

The Kelly Criterion is one of many models that can be used to help you diversify. The Importance Of Diversification , 5 Tips for Diversifying Your Portfolio and Achieving Optimal Asset Allocation.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Money Management Using The Kelly Criterion By Justin Kuepper Share. These two factors are then put into Kelly's equation: Putting It to Use Kelly's system can be put to use by following these simple steps: Access your last trades.

You can do this by simply asking your broker , or by checking your recent tax returns if you claimed all your trades. If you are a more advanced trader with a developed trading system, then you can simply back test the system and take those results. The Kelly Criterion assumes, however, that you trade the same way you traded in the past.

Calculate "W", the winning probability.

A Comparison of Programming Languages

To do this, divide the number of trades that returned a positive amount by your total number of trades positive and negative. This number is better as it gets closer to one. Any number above 0. Do this by dividing the average gain of the positive trades by the average loss of the negative trades. You should have a number greater than 1 if your average gains are greater than your average losses. A result less than one is manageable as long as the number of losing trades remains small.

Input these numbers into Kelly's equation: Record the Kelly percentage that the equation returns. Here is an example: Despite calls from its unions to oust CEO Gary Kelly, the board is sticking with their leader who has been able to deliver three years of record profits.

Gail Kelly, former CEO of Westpac Banking Corporation NYSE: WBK , is currently enthralled with four books, each highlighting her journey through retirement. Adopting realistic expectations is essential to staying in the trading game.

These steps will make you a more disciplined, smarter and, ultimately, wealthier trader. Most brokers will provide you with trade records, but it's also important to keep track on your own.

Investment - Wikipedia

Learn to add structure to your trading methods with these six important steps. In a word, yes.

Now, how do you get your hands on a coveted Kelly or Birkin? An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

Arbitrage betting calculator | Trading, dutching & DNB

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.