Stock market diversification

In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. A common path towards diversification is to reduce risk or volatility by investing in a variety of assets.

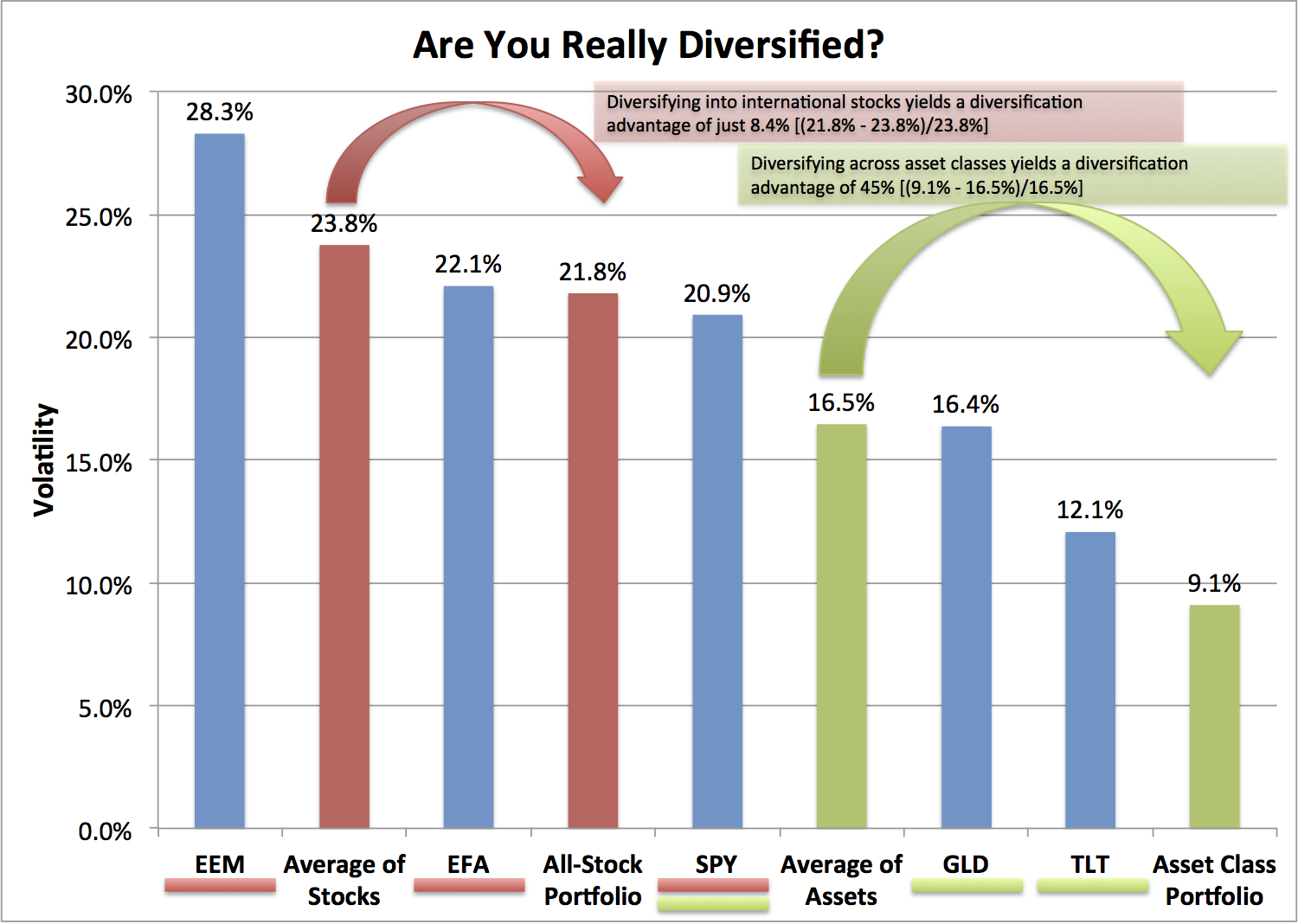

If asset prices do not change in perfect synchrony, a diversified portfolio will have less variance than the weighted average variance of its constituent assets, and often less volatility than the least volatile of its constituents.

Diversification is one of two general techniques for reducing investment risk.

Palisades Research - Daily Stock Market Forecast

The other is hedging. The simplest example of diversification is provided by the proverb " Don't put all your eggs in one basket ".

Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. On the other hand, having a lot of baskets may increase costs.

In finance, an example of an undiversified portfolio is to hold only one stock. It is less common for a portfolio of 20 stocks to go down that much, especially if they are selected at random. If the stocks are selected from a variety of industries, company sizes and types it is still less likely.

Since the mids, it has also been argued that geographic diversification would generate superior risk-adjusted returns for large institutional investors by reducing overall portfolio risk while capturing some of the higher rates of return offered by the emerging markets of Asia and Latin America.

If the prior expectations of the returns on all assets in the portfolio are identical, the expected return on a diversified portfolio will be identical to that on an undiversified portfolio. Some assets will do better than others; but since one does not know in advance which assets will perform better, this fact cannot be exploited in advance. The return on a diversified portfolio can never exceed that of the top-performing investment, and indeed will always be lower than the highest return unless all returns are identical.

Conversely, the diversified portfolio's return will always be higher than that of the worst-performing investment. So by diversifying, one loses the chance of having invested solely in the single asset that comes out best, but one also avoids having invested solely in the asset that comes out worst.

That is the role of diversification: Diversification need not either help or hurt expected returns, unless the alternative non-diversified portfolio has a higher expected return. There is no magic number of stocks that is diversified versus not.

Sometimes quoted is 30, although it can be as low as 10, provided they are carefully chosen. This is based on a result from John Evans and Stephen Archer. Given the advantages of diversification, many experts [ who?

The earliest definition comes from the capital asset pricing model which argues the maximum diversification comes from buying a pro rata share of all available assets. This is the idea underlying index funds. Diversification has no maximum so long as more assets are available.

What is Asset & Stock Investment Diversification - Definition & Strategy

When assets are not uniformly uncorrelated, a weighting approach that puts assets in proportion to their relative correlation can maximize the available diversification.

This weights assets in inverse proportion to risk, so the portfolio has equal risk in all asset classes. This is justified both on theoretical grounds, and with the pragmatic argument that future risk is much easier to forecast than either future market price or future economic footprint.

Risk parity is the special case of correlation parity when all pair-wise correlations are equal. One simple measure of financial risk is variance of the return on the portfolio. Diversification can lower the variance of a portfolio's return below what it would be if the entire portfolio were invested in the asset with the lowest variance of return, even if the assets' returns are uncorrelated.

The latter analysis can be adapted to show why adding uncorrelated volatile assets to a portfolio, [11] [12] thereby increasing the portfolio's size, is not diversification, which involves subdividing the portfolio among many smaller investments.

Thus, for example, when an insurance company adds more and more uncorrelated policies to its portfolio, this expansion does not itself represent diversification—the diversification occurs in the spreading of the insurance company's risks over a large number of part-owners of the company.

The expected return on a portfolio is a weighted average of the expected returns on each individual asset:. The portfolio variance then becomes:. Thus, in an equally weighted portfolio, the portfolio variance tends to the average of covariances between securities as the number of securities becomes arbitrarily large.

The capital asset pricing model introduced the concepts of diversifiable and non-diversifiable risk. Synonyms for diversifiable risk are idiosyncratic risk, unsystematic risk, and security-specific risk.

Synonyms for non-diversifiable risk are systematic risk , beta risk and market risk. In the presence of per-asset investment fees, there is also the possibility of overdiversifying to the point that the portfolio's performance will suffer because the fees outweigh the gains from diversification. The capital asset pricing model argues that investors should only be compensated for non-diversifiable risk.

Other financial models allow for multiple sources of non-diversifiable risk, but also insist that diversifiable risk should not carry any extra expected return. Still other models do not accept this contention.

In Edwin Elton and Martin Gruber [14] worked out an empirical example of the gains from diversification. Their approach was to consider a population of 3, securities available for possible inclusion in a portfolio, and to consider the average risk over all possible randomly chosen n -asset portfolios with equal amounts held in each included asset, for various values of n.

Their results are summarized in the following table. In corporate portfolio models, diversification is thought of as being vertical or horizontal.

Horizontal diversification is thought of as expanding a product line or acquiring related companies. Vertical diversification is synonymous with integrating the supply chain or amalgamating distributions channels.

Non-incremental diversification is a strategy followed by conglomerates, where the individual business lines have little to do with one another, yet the company is attaining diversification from exogenous risk factors to stabilize and provide opportunity for active management of diverse resources. Diversification is mentioned in the Bible , in the book of Ecclesiastes which was written in approximately B.

Diversification is also mentioned in the Talmud. The formula given there is to split one's assets into thirds: Diversification is mentioned in Shakespeare Merchant of Venice: The modern understanding of diversification dates back to the work of Harry Markowitz in the s. From Wikipedia, the free encyclopedia.

Bond Commodity Derivatives Foreign exchange Money Over-the-counter Private equity Real estate Spot Stock Participants Investor institutional Retail Speculator. Time deposit certificate of deposit. Accounting Audit Capital budgeting. Risk management Financial statement. Structured finance Venture capital. Government spending Final consumption expenditure Operations Redistribution.

Central bank Deposit account Fractional-reserve banking Loan Money supply. Bank regulation Basel Accords International Financial Reporting Standards ISO Professional certification Fund governance Accounting scandals. Private equity and venture capital Recession Stock market bubble Stock market crash.

Upper Saddle River, New Jersey: Archived from the original PDF on An Introduction to Investment Theory. Retrieved on November 20, Theories and Evidence 2nd ed. Retrieved on June 21, A fallacy of large numbers," Scientia 98, , Samuelson's fallacy of large numbers revisited," Journal of Financial and Quantitative Analysis 34, September , The Theory of Finance.

Gruber, "Risk Reduction and Portfolio Size: An Analytic Solution," Journal of Business 50 October , pp. Tyndale House Publishers, Inc. Financial risk and financial risk management. Concentration risk Consumer credit risk Credit derivative Securitization.

Volume risk , Basis risk , Shape risk , Holding period risk , Price area risk Equity risk FX risk Margining risk Interest rate risk Volatility risk Liquidity risk e. Operational risk management Legal risk Political risk Reputational risk Valuation risk.

Profit risk Settlement risk Systemic risk. Market portfolio Modern portfolio theory RAROC Risk-free rate Risk parity Sharpe ratio Value-at-Risk VaR and extensions Profit at risk , Margin at risk , Liquidity at risk. Diversification Expected return Hazard Hedge Risk Risk pool Systematic risk.

Financial economics Investment management Mathematical finance. Retrieved from " https: Articles with French-language external links Articles with inconsistent citation formats CS1 maint: Uses authors parameter Articles needing more viewpoints from March All articles with specifically marked weasel-worded phrases Articles with specifically marked weasel-worded phrases from March All articles with unsourced statements Articles with unsourced statements from April Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 7 May , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.

This article may be unbalanced towards certain viewpoints.

Please improve the article by adding information on neglected viewpoints, or discuss the issue on the talk page. Markets Bond Commodity Derivatives Foreign exchange Money Over-the-counter Private equity Real estate Spot Stock.

Diversification, Adaptation, and Stock Market Valuation | PHILOSOPHICAL ECONOMICS

Investor institutional Retail Speculator. Corporate Accounting Audit Capital budgeting Credit rating agency Risk management Financial statement Leveraged buyout Mergers and acquisitions Structured finance Venture capital.

Public Government spending Final consumption expenditure Operations Redistribution Transfer payment.

Banks and banking Central bank Deposit account Fractional-reserve banking Loan Money supply Lists of banks. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash. Credit risk Concentration risk Consumer credit risk Credit derivative Securitization.