Call option put option wiki

A call option is an agreement that gives an investor the right, but not the obligation, to buy a stock, bond, commodity or other instrument at a specified price within a specific time period.

Call option

It may help you to remember that a call option gives you the right to call in, or buy, an asset. You profit on a call when the underlying asset increases in price.

Put option financial definition of put option

Call options are typically used by investors for three primary purposes. These are tax management, income generation and speculation.

An options contract gives the holder the right to buy shares of the underlying security at a specific price, known as the strike priceup until a specified date, known as the expiration date. As the value of Apple stock goes up, the price of the options contract goes up, and vice versa.

Options contract holders can hold the contract until the expiration date, at which point they can take delivery of the shares of stock or sell the options contract at any point before the expiration date at the market price if stock splits happens options the contract at the time.

Investors sometimes use options as a means of changing the allocation of their portfolios without actually buying or selling the underlying security.

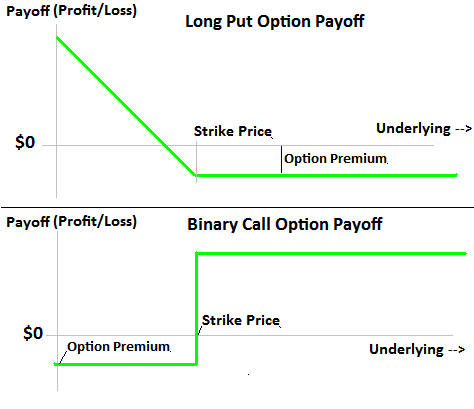

Put Option

For example, an investor may own shares of Apple stock and be sitting on a large unrealized capital gain. Not wanting to trigger a taxable eventshareholders may use options to reduce the exposure to the underlying security forex hacked scalping settings actually call option put option wiki it.

The only cost to the shareholder for engaging in this strategy is the cost of the options contract itself. Some investors use call options to generate income through a covered call strategy.

Call option put option wiki strategy involves owning an underlying stock while at the same time selling a call option, or giving someone else the right to buy your stock. The investor collects the option premium and hopes the option expires worthless. This strategy generates additional income for the investor but can also limit profit potential if the underlying martingale trade system price rises sharply.

Options contracts give buyers the opportunity to obtain significant exposure to a stock for a relatively small price.

Options contracts should be considered very risky if used for speculative purposes because of the high degree of leverage involved. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Stock Option Expiration Date Derivatives Options Contract Put On A Call Basket Option Currency Option Exercise Writing An Option Options On Futures.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Call Option

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.