Historical stock market pe ratios

This page was added to your Bookmark. Please Sign Up or Log In first. Market Overvalued, How to Invest? GuruFocus Buffett-Munger Screener is the screen for high quality companies at undervalued prices.

The portfolio of Buffett-Munger companies has outperformed the market every year. Check Out the Buffett-Munger Screener Date: Tue, 20 Jun This is similar to market valuation based on the ratio of total market cap over GDP , where the variation of profit margins does not play a role either.

Here you can see the Sector Shiller PE , it shows you which sectors are the cheapest. During economic expansions, companies have high profit margins and earnings.

What Shiller P/E ratio says about market’s top - MarketWatch

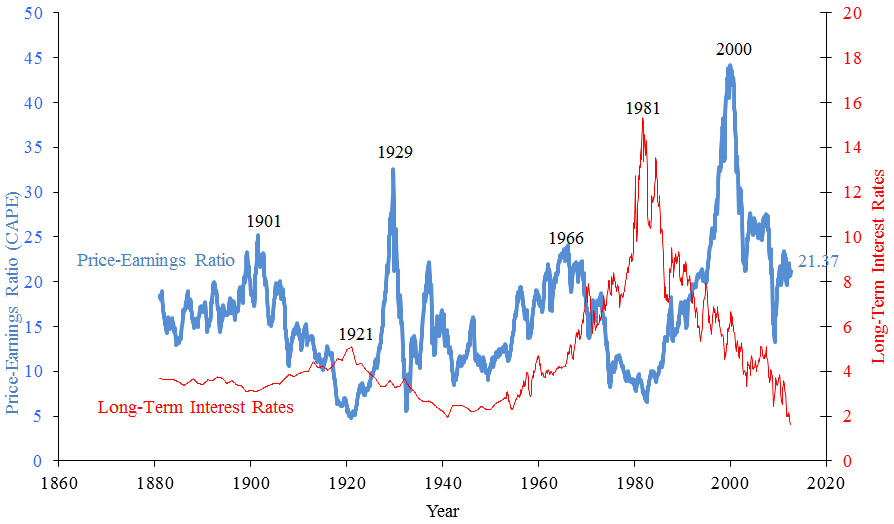

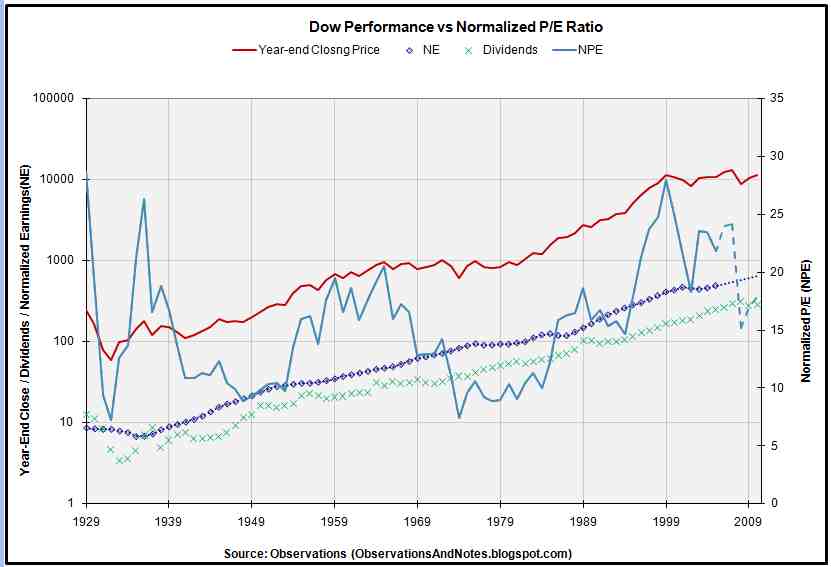

During recessions, profit margins are low and earnings are low. It is most obvious in the chart below: The investment return is thus equal to: This is the historical implied return, actual return and long term interest. Interest rate does have an impact on the market returns. Historical market returns prove that when the market is fair or overvalued, it pays to be defensive.

S&P PE Ratio

Companies with high quality business and strong balance sheet will provide better returns in this environment. When the market is cheap, beaten down companies with strong balance sheets can provide outsized returns.

Again, here you can see the Sector Shiller PE , it shows you which sectors are the cheapest. Under no circumstances does any information posted on GuruFocus. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations.

The gurus may buy and sell securities before and after any particular article and report and information herein is published, with respect to the securities discussed in any article and report posted herein. In no event shall GuruFocus. Past performance is a poor indicator of future performance. The information on this site is in no way guaranteed for completeness, accuracy or in any other way.

The gurus listed in this website are not affiliated with GuruFocus. Stock quotes provided by InterActive Data. Fundamental company data provided by Morningstar, updated daily. Homepage Membership Levels Membership Data Coverage Complete Stock List Founder's Message The Book FREE Trial. Latest Guru Picks Real Time Picks List of Gurus Personalize Gurus Portfolios Scoreboard Top 10 Holdings View Sector Picks International Picks Aggregated Portfolio Consensus Picks Guru Bargains Hot Picks Industry Trends Geographic Trend ETFs Options European Shorting.

By Country USA Australia Canada China Germany India Japan UK More Articles Editor's Picks GuruFocus Research Value Ideas Interviews with Gurus Top Ranked Value Idea Contest Videos Following Authors. Submit Articles Writers Wanted Value Contest Winners Submit Articles Online My Articles. Free Sign-up Log In 7-Day Free Trial.

Get 7-Day Free Trial.

S&P PE Ratio

Check Out the Buffett-Munger Screener. Adjust the past earnings for inflation using CPI; past earnings are adjusted to today's dollars.

Average the adjusted values for E When the market is fair valued or overvalued, buy high-quality companies such as those in the Buffett-Munger Screener. When the market is undervalued, buy low-risk beaten-down companies like those in the Ben Graham Net-Net Screener.

Buy a basket of them and be diversified. If market is way over valued, stay in cash.

You may consider hedging or short. Add Notes, Comments If you want to ask a question or report a bug, please create a support ticket. Get WordPress Plugins for easy affiliate links on Stock Tickers and Guru Names Earn affiliate commissions by embedding GuruFocus Charts GuruFocus Affiliate Program: GuruFocus Premium Plus Membership.