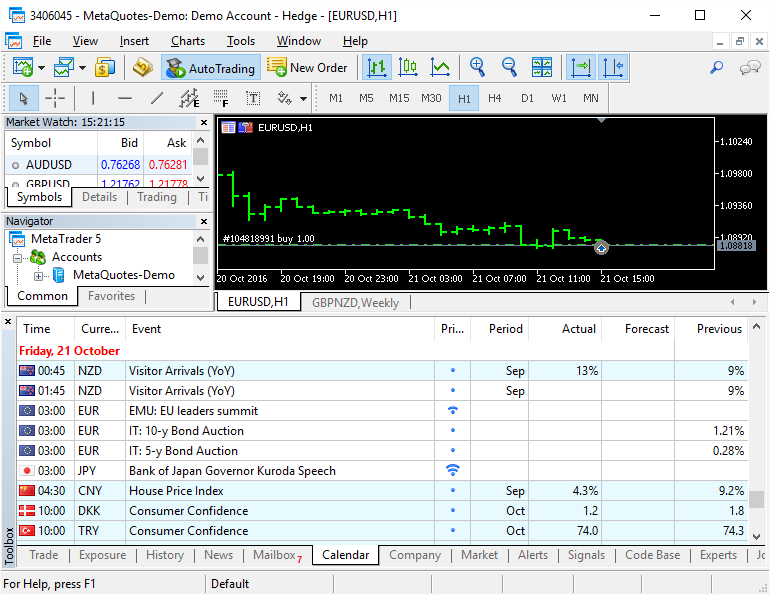

Mt5 forex economic calendar

Evaluates the monthly change in overall production by all sectors of the Japanese economy. The index comprises a variety of industries: The index closely follows Japanese GDP and overall growth figures, providing insight into current levels of Japanese economic expansion.

The All Industry Activity Index is posted monthly as a percentage change from the previous month's figure. Records sales of previously owned homes in the United States. This report provides a fairly accurate assessment of housing market conditions, and because of the sensitivity of the housing market to business cycle twists, it can be an important indicator of overall conditions at times when housing is particularly important to the economy. While used home sales are not counted in GDP, they do affect the United States economy.

Sellers of used homes often use capital gains from property sales on consumption that stimulate the economy. Higher levels of consumer spending may also increase inflationary pressures, even as they help grow the economy.

The existing home sales report is not as timely as other housing indicators like New Home Sales or Building Permits.

By the time the Existing Home Sales are recorded, market conditions may have changed. The actual inventories of crude oil, gasoline, and distillate, such as jet fuel, as reported on a weekly basis. The numbers are watched closely by the energy markets, and if the results differ greatly from the expected inventory levels, the market can react strongly.

The inventory data can be skewed by holidays and seasonal factors. Weekly data can be unreliable and should be viewed as a part of longer-term trends, so a four-week moving average may be more useful. The Reserve Bank of New Zealand RBNZ releases this statement in connection to its recent decision on short-term interest rates. Interest rates are a primary determinant of a currency's value and these statements are used by traders to determine future monetary policy decisions.

A country's trade balance reflects the difference between exports and imports of goods and services.

The trade balance is one of the biggest components of the Balance of Payment, giving valuable insight into pressures on country's currency. Surpluses and Deficits A positive Trade Balance surplus indicates that exports are greater than imports. When imports exceed exports, the country experiences a trade deficit.

Because foreign goods are usually purchased using foreign currency, trade deficits usually reflect currency leaking out of the country. Such currency outflows may lead to a natural depreciation unless countered by comparable capital inflows inflows in the form of investments, FDI - where foreigners investing in local equity, bond or real estates markets. At a bare minimum, deficits fundamentally weigh down the value of the currency. Ramifications of Trade Balance on Markets There are a number of factors that work to diminish the market impact of Trade Balance upon immediate release.

The report is not very timely, coming some time after the reporting period. Developments in many of the figure's components are also typically anticipated well beforehand. Lastly, since the report reflects data for a specific reporting month or quarter, any significant changes in the Trade Balance should plausibly have already been felt during that period - and not during the release of data.

However, because of the overall significance of Trade Balance data in forecasting trends in the Forex Market, the release has historically been one of the most important reports out of the any country. Gauge for goods sold at retail outlets in the past month. Retail Sales is a leading indicator for the economy. Rising consumer spending fuels economic growth, confirms signals from consumer confidence, and may spark inflationary pressures.

This index characterizes the volume of new orders in the industrial sector. The growth of industrial orders is a sign that the economy expands.

Increase in orders leads to higher employment in the industry. Increase in orders will lead to further growth in manufacturing, and hence lead to growth of the national currency and domestic stock market. In the bond market, this leads to an increase in profitability of government securities.

The index is certainly important for the market. Sometimes a strong deviation from the forecast values of the index can cause a strong change of the pound sterling rate. Certainly, the indicator is not able to deploy the prevailing trend.

Continuing claims refers to unemployed workers that qualify for benefits under unemployment insurance. In order to be included in continuing claims, the person must have been covered by unemployment insurance and be currently receiving benefits. Data on unemployment claims is published by the Department of Labor on a weekly basis, allowing for frequent updates on the levels of unemployment. A broad measure of the movement of single-family house prices. Apart from serving as an indicator of house price trends, the House Price Index HPI provides an analytical tool for estimating changes in the rates of mortgage defaults, prepayments and housing affordability.

It is a weighted, repeat-sales index, which means that it measures average price changes in repeat sales or refinancings on the same properties. In general, rising consumer confidence precedes increased consumer spending, which drives both economic growth and inflation. Even though t he Italian economy is heavily driven by its export sector, domestic consumer confidence is an important gauge of overall economic activity and future inflationary pressures.

A headline figure above 50 shows positive consumer sentiment, while a number below 50 shows negative consumer sentiment; the greater the distance, the stronger the sentiment. A monthly gauge of manufacturing activity and future outlook. The CIPS PMI is comparable to the US ISM survey, similarly based on the opinions of executives in manufacturing companies.

Purchasing managers are tasked with gauging future demand, and adjusting orders for materials accordingly. The PMI summarizes the opinions of these executives to give a picture of the future of the manufacturing sector. A higher PMI indicates that materials purchases are increasing and that the economic outlook is positive. Alternately, a lower PMI means orders for materials are down and the future outlook is less favorable. By nature, the figure is very sensitive to the business cycle and tends to match growth or decline in the economy as a whole.

Gauge for the overall performance of the country's service sector. The Services PMI interviews executives on the status of sales, employment, and their outlook. Because the performance of the country's service sector is extremely consistent over time, services does not impact final GDP figures as much as the more volatile figure on the manufacturing sector. For this reason Services PMI usually causes little market movement.

The survey results are quantified and presented as an index on a scale. The headline figure is the percentage change in the index. The PMI is based on the opinions of executives in manufacturing companies. Purchasing managers are tasked with gauging future demand and adjusting orders for materials accordingly. Gauge for overall performance of the German manufacturing sector. Through asking executives about sales and employment outlook, the survey strives to provide useful information about the business climate that can lead to developments in employment, output and consumption.

The PMI survey is based on the result of interviews with business executives. Manufacturing is an important sector in Germany, which is why changes in Manufacturing PMI serve as a good indicator for the overall economic situation in Germany as well as Eurozone.

However, despite the timeliness of the report, Manufacturing PMI is not a big market mover. The survey results are quantified into index where 0 represents long-term manufacturing business conditions. The headline figure is expressed in percentage change.

Free download of the 'FFC - Forex Factory Calendar' indicator by 'awran5' for MetaTrader 4 in the MQL5 Code Base

Gauge for the overall performance of the German service sector. The Services PMI interviews German executives on the status of sales, employment, and their outlook.

Because the performance of the German service sector is extremely consistent over time, services does not impact final GDP figures as much as the more volatile figure on the manufacturing sector. The Eurozone Services Purchasing Managers Index PMI assesses business conditions in the services sector. The figure is based on monthly surveys of executives in Germany, France, Ireland, Italy and Spain. Combined, these countries account for roughly four fifths of total service sector activity in the Eurozone.

Since services account for two thirds of total Eurozone GDP, the Services PMI is a significant and timely indicator for the health of the economy. Higher Service PMI levels suggest upward future trends in output and performance of the industry. The headline figure is reported as an index where 50 reflects the centerline of boom-bust sentiment. A larger divergence from 50 indicates a larger rate of change in business conditions. The Eurozone Composite Purchasing Managers Index PMI assesses business conditions in manufacturing, construction and service sectors.

The Eurozone PMI is both a significant and timely indicator of business conditions and the general health of the economy. Close correlation with the business cycle, assessed on the basis of long-term statistical data, allows to use the PMI indicator for prognosis of future GDP volumes.

The key gauge for inflation in Canada. Simply put, inflation reflects a decline in the purchasing power of the Canadian Dollar, meaning each Dollar buys fewer goods and services. CPI is the most obvious way to measure changes in purchasing power - the report tracks changes in the price of a basket of goods and services that a typical Canadian household might purchase.

An increase in the index indicates that it takes more Dollars to purchase this same set of basic consumer items. As the most important indicator of inflation in Canada , Consumer Price figures are closely followed by Canada 's central bank. A rising CPI may prompt the central bank to raise interest rates in order to manage inflation and slow economic growth.

Higher interest rates make holding the Dollar more attractive to foreign investors, and this higher level of demand will place upward pressure on the value of the Dollar. The Consumer Price Index excluding eight items which the Bank of Canada has deemed to have the most volatility from month to month.

Forex Promotions | Promotions Forex | Forex Bonuses

The goods omitted tend to fluctuate idiosyncratically and may distort CPI data. The headline figure for CPI is the percentage change in the index on a month to month and year to year basis. These Eight items include: Changes in the CPI Excluding the Core 8 are recognized as a better indicator of inflation than the regular CPI.

The headline figure is reported as a percent change on both the month to month and year to year basis. Level of a composite index based on surveyed manufacturers, builders, services and trade-related firms.

It's a leading indicator of economic health - businesses react quickly to market conditions, and changes in their sentiment can be an early signal of future economic activity such as spending, hiring, and investment. Records sales of newly constructed residences in the United States. The figure is a timely gauge of housing market conditions counting home sales when initial housing contracts are signed. Because New Home Sales usually trigger a sequence of consumption, they have significant market impact upon release.

In addition to the high expenditure of the new home, buyers are likely to spend more money on furnishing customizing and financing their home. Consequently, growth in the housing market spurs more consumption, generating demand for goods, services and the employees who provide them. Generally, the housing market is tracked by a number of reports that mark different stages of the construction and home sale process. The first stage is Building Permits, which precede Housing Starts, which lead to Construction Spending, MBA Mortgage Applications and, finally, New Home Sales and Existing Home Sales.

Major financial and economic news

As the headline housing figure, New Home Sales are believed to control some of the volatility of other data. For instance, Building Permits and Housing Starts are considered more indicative of business confidence and production rather than consumer spending. And while Existing Home Sales figures are more indicative of consumer expenditures, they are lagging indicators with less predictive value. New Home Sales numbers are considered confirmatory of housing trends and still predictive of consumer spending.

New Home Sales is also a good indicator of economic turning points due to its sensitivity to consumer income. Buying a house is always a major expenditure, typically only undertaken when consumers have sufficient savings or are optimistic about future earnings. Historically, when economic conditions slow, New Home Sales are one of the first indicators to reflect the change. By the same token, New Home Sales undergo substantial growth when the economy has emerged from recession and wages have begun to pick up.

Analytics Calendar Forex news Forex analysis Video news Prime News Photo News Interview Subscribe to Newsletter. Forex Info Trading Forex signals Brokers review Indicators Forex Articles Advisors MQL Forex trading hours Meta Trader 5 Forex RSS feeds Forex Catalogue Interesting to know About Forex Forex book reviews National Holidays Video tutorials Developing countries Dossier MT5 Forex Glossary Promo items. Tools Quotes online Forex charts Forex-calculator Volatility calculator Forex tick charts Forex informers Currency converter Forex symbols.

Relax Forex Contests Forex Humor Forex Games InstaForex Cinema Festival. Verdana, Arial, sans-serif; font-size: M5 M15 M30 H1 H4 D1 W1 EURUSD 1. Currency pair Bid Ask EURUSD 1. Monetary Policy Meeting Min Monetary Policy Meeting Minutes Period: The Bank of Japan publishes the summary from its monthly monetary policy meetings some time after the actual meeting.

MI Leading Index Period: All Industries Activity Period: Public Sector Net Borrowing. Public Sector Net Borrowing Period: Public sector net borrowing is the measure of fiscal surpluses and deficits along with the amount of new debt created. If this number is positive, it means the U. MPC Member Andy Haldane Spe MPC Member Andy Haldane Speaks Period: He was acknowledged as being one amongst the world's most influential people. His speeches are mainly focused on financial stability, monetary issues and market risks.

SNB Quarterly Bulletin Period: Tends to have a mild impact because much of the information is released 2 weeks earlier in the Monetary Policy Assessmen. Existing Home Sales Period: The headline is the total value of properties sold.

Crude Oil Inventories Period: Official Cash Rate Period: The Official Cash Rate OCR is the interest rate set by the Reserve Bank to meet the inflation target specified in the Policy Targets Agreement PTA. The current PTA, signed in September , defines price stability as annual increases in the Consumers Price Index CPI of between 1 and 3 per cent on average over the medium term, with a focus on keeping future average inflation near the 2 percent target midpoint.

RBNZ Rate Statement Period: Credit Card Spending Period: Shows a change in the total expenditure made via credit cards. ECB Economic Bulletin Period: It reveals the statistical data that the ECB Governing Board evaluated when making the latest interest rate decision, and provides detailed analysis of current and future economic conditions from the bank's viewpoint.

The headline figure is expressed as the percentage change from the same month last year. CBI Industrial Order Expect CBI Industrial Order Expectations Period: Get code of Forex informer. Forex news is a steady, regularly updated online feed of fresh information from the leading media agencies of the world. Hot news provided below will keep you on top of the events in the world of economy, finance, policy, and forex market that have a direct impact on currency exchange rates. Direct Impact Of Fall In Sterling On Cost Inflation Eased.

Uk Budget Deficit Narrows In May. Pound Little Changed After U. Public Sector Finance Data. Pound Falls Ahead Of U. Sweden's Economic Growth Likely To Slow: Swedish Economic Sentiment Strengthens In June.

Sweden Inflation Seen At 1. Sweden Jobless Rate To Fall To 6. Sweden Gdp To Grow 2. The Existing Home Sales data from the US are scheduled for release at Market participants expect sales of previously owned homes in the United States to show again a high level of performance Ichimoku indicator analysis of USDX for June 21, Ichimoku indicator analysis of gold for June 21, Daily analysis of major pairs for June 21, Daily analysis of USDX for June 21, Analysis of Gold for June 20, Detailed Forex economic calendar.

How News Affect Forex? The administrators and holders of the web resource do not warrant the accuracy of the information and shall not be liable for any damage directly or indirectly related to the content of the website. It should be borne in mind that trading on Forex carries a high level of risk. Before deciding to trade on the Forex market, you should carefully consider losses that you may incur when trading online.

You should remember that prices for stocks, indexes, currencies, and futures on the MT5 official website may differ from real-time values. If you have decided to start earning money on Forex, having weighed the pros and cons, you can find a wide range of useful information including charts, quotes of financial instruments, trading signals, and tutorials on the web portal.

Improve your trading efficiency with information acquired from MT5. MPC Member Andy Haldane Speaks.

CBI Industrial Order Expectations. FOMC Member Jerome Powell Speaks. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, Thus, he actively participates in the monetary policy development. Prior to his appointment to the Board, Mr.

Powell was a visiting scholar at the Bipartisan Policy Center in Washington, D. His comments may influence the market as they may unveil the Committee's sentiment on monetary policy. MPC Member Kristin Forbes Speaks. Professor Kristin Forbes joined the Monetary Policy Committee of the Bank of England in July of Professor Forbes academic research addresses policy-related questions in international macroeconomics, including topics such as capital flows, contagion, and financial crises.

Forbes was named a "Young Global Leader" as part of the World Economic Forum at Davos. She is a research associate at the NBER and a member of the Bellagio Group and Council on Foreign Relations. She was previously on the academic advisory board of the Congressional Budget Office, Peterson Institute for International Economics, and Center for Global Development. Before joining MIT, Forbes worked at the World Bank and Morgan Stanley.

The PMI is presented as an index with a value between An index level of 50 denotes no change since the previous month, while a level above 50 signals an increase or improvement, and below 50 indicates a decrease or deterioration. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy.

Survey of about purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories.

There are 2 versions of this report released about a week apart — Flash and Final. The Flash release, which the source first reported in Jun , is the earliest and thus tends to have the most impact. Consumer Price Index Core. CPI Excluding Core Eight The Consumer Price Index excluding eight items which the Bank of Canada has deemed to have the most volatility from month to month. The Common calculation helps expose the underlying inflation trend through filtering out price movements that might be caused by factors specific to certain components.

Source first released in Dec Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate.

The Median calculation helps expose the underlying inflation trend through exclusion of extreme price movements specific to certain components.

The Trimmed Mean calculation helps expose the underlying inflation trend through component weighting and anomaly exclusion. The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over executives in private sector service companies. An index level of 50 denotes no change since the previous month, while a level above 50 signals an improvement, and below 50 indicates a deterioration. A reading that is stronger than forecast is generally supportive bullish for the USD, while a weaker than forecast reading is generally negative bearish for the USD.

The Flash release, which the source first reported in May , is the earliest and thus tends to have the most impact. The report headline is the total amount of properties sold. FOMC Member James Bullard Speaks. James Bullard is the chief executive officer and 12th president of the Federal Reserve Bank of St. Louis, positions he has held since He is currently serving a term that began on March 1, In , he was named the 7th most influential economist in the world.

FOMC Member Loretta Mester Speaks. Federal Reserve Bank of Cleveland President Loretta Mester. Federal Reserve FOMC members vote on where to set the nation's key interest rates and their public engagements are often used to drop subtle clues regarding future monetary policy.

The Baker Hughes rig count is an important business barometer for the oil drilling industry. When drilling rigs are active they consume products and services produced by the oil service industry.

The active rig count acts as a leading indicator of demand for oil products. This report includes the BOJ's projection for inflation and economic growth. It's the primary tool the BOJ uses to communicate their economic and monetary projections to investors.

Fed Monetary Policy Report. Report provides a summary of discussions of the conduct of monetary policy and economic developments and prospects for the future. It is submitted, along with testimony from the Federal Reserve Chair, to the Senate Committee on Banking, Housing, and Urban Affairs and to the House Committee on Financial Services.

Cooperation Disclaimer Advertise with us About MT5.