Broker client currency desk exchange forex maker market retail trading

Unlike most other exchanges such as the New York Stock Exchange or the Chicago Board of Tradethe FX market is not a centralized market. In a centralized market, each transaction is recorded by price dealt and volume traded.

There is usually one central place back to which all trades can be traced and there is often one specialist or market maker. The currency market, however, is a decentralized market.

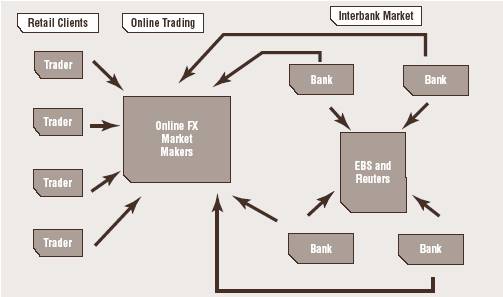

Watch high-speed trading in actionThere isn't one "exchange" where every trade is recorded. Instead, each market maker records his or her own transactions and keeps it as proprietary information. The primary market makers who make bid and ask spreads in the currency market are the largest banks in the world. They deal with each other constantly either on behalf of themselves or their customers. This is why the market on which banks conduct transactions is called the interbank market.

The competition between banks ensures tight spreads and fair pricing. For individual investors, this is the source of price quotes and is where forex brokers offset their positions. Most individuals are unable to access the pricing available on the interbank market because the customers at the interbank desks tend to include the largest mutual and hedge funds in the world as well as large multinational corporations who have millions if not billions of dollars.

Despite this, it is important for individual investors to understand how the interbank market works because it is one the best ways to understand how retail spreads are priced, and to decide whether you are getting fair pricing from your broker. Read on to find out how this market works and how its inner workings can affect your investments.

Who makes the prices? Trading in a decentralized market has its advantages and disadvantages. In a centralized market, you have the benefit of seeing volume in the market as a whole but at the same time, prices can easily be skewed to accommodate the interests of the specialist and not the trader.

The international nature of the interbank market can make it difficult to regulate, however, with such important players in the market, self-regulation is sometimes even more effective than government regulations. For the individual investor, a forex broker must be registered with the Commodity Futures Trading Commission as a futures commission merchant and be a member of the National Futures Association NFA.

The CFTC regulates the broker and ensures that he or she meets strict financial standards. For more insight on determining whether you're getting a fair price from your broker, read Is Your Forex Broker A Scam?

- Kategori ikke fundet

Most of the total forex volume is transacted through about 10 banks. These banks are the brand names that we all know well, including Deutsche Bank NYSE: DBUBS NYSE: UBSCitigroup NYSE: C and HSBC NYSE: Each bank is structured differently but most banks will have a separate group known as the Foreign Exchange Sales and Trading Department.

This group is responsible for making prices for the bank's clients and for offsetting that risk with other banks. Within the foreign exchange group, there is a sales and a trading desk.

The sales desk is generally responsible for taking the orders from the client, getting a quote from the spot trader and relaying the quote to the client to see if they want to deal on it. This is because most platforms offered by banks will have a trading size limit because the dealer wants to make sure that it is able to offset the risk. On a foreign exchange spot trading desk, there are generally one or two market makers responsible for each currency pair.

He or she may have a secondary dealer that gives quotes on a smaller transaction size. This setup is mostly true for the four majors where the dealers see a lot of activity. For the commodity currencies, there may be one dealer responsible for all three commodity currencies or, depending upon how much volume the bank sees, there may be two dealers.

This is important because the bank wants to make sure that each dealer knows its currency well and understands the behavior of the other players in the market. Usually, the Australian dollar dealer is also responsible for the New Zealand dollar and there is often a separate dealer making quotes for the Canadian dollar.

There usually isn't a " crosses " dealer - the primary dealer responsible for the more liquid currency will make the quote. For example, the Japanese yen trader will make quotes on all yen crosses. Finally, there is one additional dealer that is responsible for the exotic currencies such as the Mexican peso and the South African rand.

This setup is usually mimicked across three trading centers - London, New York and Tokyo. Each center passes the client orders and positions to another trading center at the end of the day to ensure that client orders are watched 24 hours a day. How do banks broker client currency desk exchange forex maker market retail trading the price? Bank dealers will determine their prices based upon a variety of factors including, the current market rate, how much volume is available at the current price level, their views on where the currency pair is headed and their inventory positions.

Broker client currency desk exchange forex maker market retail trading and also jak zarabiać na forexie

If broker client currency desk exchange forex maker market retail trading think that the euro is headed higher, they may be willing to offer a more competitive rate for clients who want to sell euros because they believe that once they are given the euros, they can hold onto them for a few pips and offset at a better price. On dan alvarez forex trading flip side, if they think that the euro is headed lower and the client is giving them euros, they may offer a lower price because they are not sure if they can sell the euro back to the market at the same level at which it was given to them.

This is something that is unique to market makers that do not offer a american call option vba spread.

How does a bank offset risk? Ro2 how to make money to the way we see prices on an electronic forex broker's platformthere are two primary platforms that interbank traders use: The interbank market is a credit-approved system in which banks trade based solely on the credit relationships they have established with one another.

All of the banks can see the best market rates currently available; however, each bank must have a specific credit relationship with another bank in order to trade at the rates being offered.

The bigger the banks, the more credit relationships club penguin game money maker online can have and the better pricing nepal stock exchange rate today will be able access.

The same is true for clients such as retail forex brokers. The larger the retail forex broker in terms of capital available, the more favorable pricing it can get from the interbank market. If a client or even a bank is small, it is restricted to dealing with only a select number of larger banks and tends to get less favorable pricing.

Both the EBS and Reuters Dealing systems offer trading in the major currency pairs, but certain currency pairs are more liquid and are traded more frequently over either EBS or Reuters Dealing.

These two companies are continually trying to capture each other's market shares what is the average rate of return of the stock market, but as a guide, the following is the breakdown where each currency pair is primarily traded: Cross currency pairs are generally not quoted on either platform, but are calculated based on the rates of the major currency pairs and then offset through the legs.

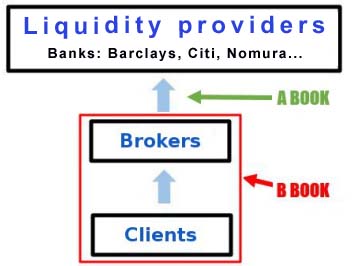

The minimum transaction size of each unit that can be dealt on either platform tends to one million of the base currency. The average one-ticket transaction size tends to five million of the base currency. To learn more, see Wading Into The Currency Market. Conclusion Individual clients then rely on online market makers for pricing. The forex brokers use their own capital to gain credit with the banks that trade on the interbank market.

The more well capitalized the market makers, the more credit relationships they can establish and the more competitive pricing they can access for themselves as well as their clients. This also means that when markets are volatile, the banks are more obligated to give their good clients continuously competitive pricing. Therefore, if a forex retail broker is not well capitalized, how they can access more competitive pricing than a well capitalized market maker remains questionable.

The structure of the market makes it extremely difficult for this to be the case. As a result, it is extremely important for individual investors to do extensive due diligence on the forex broker with which they choose to trade.

For related reading, see A Primer On The Forex MarketGetting Started In Forex and Common Questions About Currency Trading.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. The Foreign Exchange Interbank Market By Kathy Lien Share.

The forex market has a lot of unique attributes that may come as a surprise for new traders. Forex brokers set their prices based on commission, spread, or a combination of both. Traders have to be cautious in the thinly regulated forex market. Discover the best ways to find a broker who will help you succeed in the forex market. This practice puts brokers ahead of their clients, but it doesn't have to be a negative for traders.

Understanding how exchange rates are calculated and shopping around for the best rates may mitigate the effect of wide spreads in the retail forex market. Three types of commissions are used in this market. Learn how to get the best deal.

The forex market is the largest market in the world. According to the Triennial Central Bank Survey conducted by the Bank How someone makes money in forex is a speculative risk: The forex spot rate is determined by supply and demand. Banks all over the world are buying and selling different currencies The forex market allows individuals to trade on nearly all of the currencies in the world.

However, most of the trading is An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies. A period of time in which all factors of production and costs are variable.

Broker | ZuluTrade Analyzer

In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Attention Required! | Cloudflare

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.