Options strategy straddle writer

A straddle uses an identical number of calls and puts with the same strike price and expiration date on the same underlying stock or index. You buy identical calls and puts on a stock to profit in either direction from volatility, but you need a sharp and lasting move in either direction in order to profit overall.

Inversely, writing the calls and puts is a way to profit from low or declining volatility. Simply by collecting option premium payments on either side of a potentially sleepy position. There are risks, of course, but let's start with the basics:. The most you can earn from the options when writing straddles is what the options pay you initially. When writing an uncovered straddle, you usually don't intend to get the underlying stock involved.

You're just looking to profit on the value erosion of the options you write, and you'll plan to "buy to close" them or let them expire once you've earned your targeted profit. You need a margin account to write an uncovered straddle. As an example, suppose a recently volatile stock just announced earnings, and you expect its volatility will now all but cease. The options still pay well, though, so you'd like to capture the option premium as income.

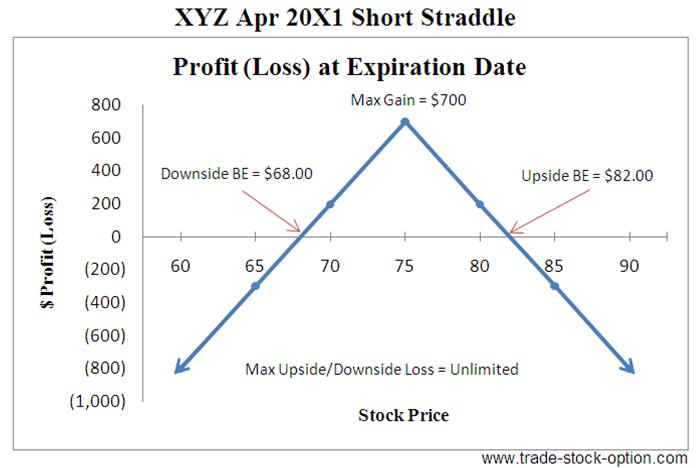

We'll call this the "profit range. However, outside your profit range, it's another story.

Your total profit declines as the stock moves away from the strike price in either direction — which is why you want minimal volatility whenever you write straddles. Take a minute to study the table to grasp how this works. As the stock rises, the naked or uncovered calls you wrote increase in value, working against you.

"Buy Straddle" Option Investment Strategy - nihoyuyipe.web.fc2.com

To help achieve a successful uncovered straddle, you want the widest possible profit range in other words, you want to capture generous option premiums. But remember, the trade creates unlimited potential losses outside the profit range. One way to greatly mitigate that risk: Doing so, you've hedged and "covered" your written straddle, and because buying these options generally costs little, you'll still begin with a net credit from your option writing and keep that profit if the stock stays in a now slightly tighter range.

If you don't buy protective options initially, be ready to do so if the trade starts to work strongly against you. Given that a steady stock can suddenly make a big move for any number of reasons, it's risky to write uncovered straddles without this added protection.

However, another route is to simply own the underlying stock outright. Let's take a look. Owning the underlying stock takes away all of the naked call option risk when writing a straddle. In fact, a covered straddle-writing strategy is basically a covered call strategy combined with put writing. The key difference with a straddle as opposed to your typical call or put writing is that both options start at-the-money, so you're more likely to see your options exercised if you don't close them.

Short StraddleAs with a covered call, it's important that you're ready to sell your stock if it rises. And as with writing puts, you need to be ready to buy more stock if it declines or close the options early. The benefits of writing a covered straddle are two-fold:. Since you own the stock, no matter how high it climbs, you're covered on that side of your trade.

Let's consider some potential outcomes:. Finally, as an example of the added flexibility here: If you had only written covered calls and not a straddle, you'd need to book a loss on your calls if you wanted to keep your stock.

Writing uncovered straddles requires keeping a close tab on your trade. If the stock is moving sharply against you in either direction, you may want take action to limit your losses. One way to do so is to close the losing side of your straddle when the stock reaches your break-even price. If the stock falls, just be ready to buy it via your puts. Uncovered straddles don't usually lend themselves to rolling forward to a later expiration date , rolling up to higher strike prices , or rolling down to lower strike prices , so you can't depend on these defensive follow-up moves being readily available to you.

As mentioned above, if you defensively buy out-of-the money protective calls and puts, if you like when you set up your straddle, your potential profit on the straddle is lower, but you won't need to actively consider follow-up action. Writing covered straddles is much less risky and requires less upkeep, but you still want to keep a watchful eye on your strategy, since only your calls are truly covered. You need to be ready to accept more shares if the stock falls below your puts' strike price.

For this reason, some investors will use a lower strike price on the puts they write, providing more leeway — but once you start to stagger strike prices on your calls and puts, you're not using a straddle anymore, you're using a strangle — and that's next in our series! In Motley Fool Options , we're not likely to write uncovered straddles without using some protective options as well.

Writing covered straddles, however, is a sensible way to increase option profits on a covered call strategy with a tame stock as long as you're also willing to buy more shares if need be.

With this strategy, you have another tool to profit no matter what the market throws your way — in this case, even if the market goes nowhere. The Ultimate Income Strategy by Motley Fool Options Analyst, Jim Gillies. Please read our terms and conditions.

The companies mentioned in the lessons are for illustration purposes only. They are not actual recommendations. Click here to contact Member Services. JOIN NOW Essentials Overview Lesson One: Getting Permission Lesson Three: Buying Options Lesson Five: Writing Options Lesson Six: Cracking the Code Lesson Seven: Exercise and Assignment Strategies Overview Lesson One: Options to Complement Your Stocks Lesson Two: Options for Specific Goals Lesson Three: Writing Covered Calls Lesson Four: Rolling Covered Calls Lesson Five: Buying Calls Lesson Six: Buying Puts for Protection Lesson Seven: Buying Puts to Short Lesson Eight: Writing Puts Lesson Nine: Masters Writing Straddles Lesson 9: Increase your profits on a covered call strategy with a tame stock — as long as you're willing to buy more shares Why Write a Straddle?

Covered Straddle

You believe a stock or index is going to hold steady or stay in a tight range. You believe a stock that was recently volatile will settle down considerably. You believe the market's overall volatility is going to decrease. Setting Up the Trade A straddle uses an identical number of calls and puts with the same strike price and expiration date on the same underlying stock or index. There are risks, of course, but let's start with the basics: Write "sell to open" an equal number of puts and calls on the same stock or index.

Use the same strike price and the same month of expiration on both options. The strike price with a straddle is "at-the-money" — as close to the current underlying stock or index price as possible.

When you write an uncovered straddle, you don't own the underlying stock, so your risk is high more on this in a minute. When you write a covered straddle, you own the stock, lowering your risk on one side of the option trade. Here the straddle works like a covered call strategy — but your returns are potentially goosed with additional put-writing income, and you need to be ready to buy more shares of the stock if it falls, just like when you write any puts. Uncovered Straddle Writing When writing an uncovered straddle, you usually don't intend to get the underlying stock involved.

Covered Straddle Writing Owning the underlying stock takes away all of the naked call option risk when writing a straddle. The benefits of writing a covered straddle are two-fold: Your profit can be higher and your profit range wider than with a mere covered call. You have more ways to close your options profitably — and still keep your stock if you like.

Let's consider some potential outcomes: You've added to your existing stock holding at a lower price. You can "buy to close" both the calls and puts by expiration and capture much of the profit while keeping your existing shares. Taking Follow-Up Action Writing uncovered straddles requires keeping a close tab on your trade.

The Foolish Bottom Line on Writing Straddles In Motley Fool Options , we're not likely to write uncovered straddles without using some protective options as well.