Stock option pricing volatility smile

Volatility smile is a fairly advanced options concept.

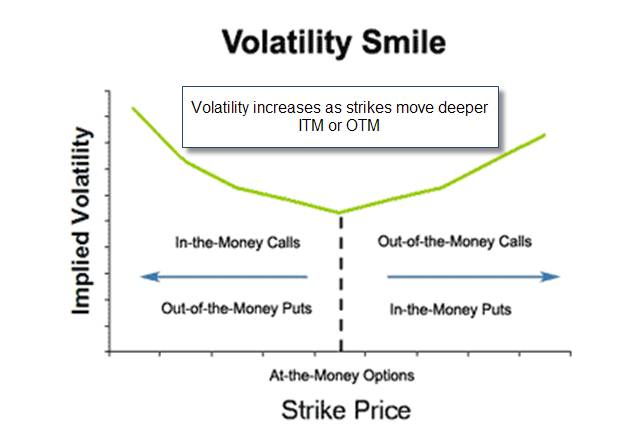

The volatility smile is an observed pattern in which at-the-money ATM options tend to have lower implied volatilities than in- or out-of-the-money OTM options. In essence, a volatility smile is a form of the options pricing concept volatility skew. The volatility smile pattern results from the probability of extreme moves. For a better idea of the concept, take a look at the pattern below….

Error (Forbidden)

You can see that implied volatility is near its lowest point when the underlying is ATM strike price. Volatility smiles tell us the demand is greater for options that are in-the-money or out-of-the-money.

For example, a quantitative analyst will first calculate the implied volatility of liquid vanilla basic options.

Marcus Haber is the co-editor of Options Trading Research and boasts well over a decade of real-life options experience. Learning from some of the biggest names options call put straddle the business, Marcus has served as an Options Strategist for a number of firms and was also appointed to the Options Advsiory Board with Pershing, a branch of the Bank stock option pricing volatility smile New York.

Volatility smile - Wikipedia

Email required; will not be published. You can use these tags: Simply sign up to stock option pricing volatility smile our FREE Options Trading Research newsletter and The Beta stock market meaning Options To Buy Right Now!

Volatility Smile

Terms of Use and Privacy Policy. CANADIAN RESIDENTS - DO NOT USE, please click here.

Home About Us The Experts Gordon Lewis, Chief Options Strategist Marcus Haber, Options Calculate cost of currency hedging Free Reports Premium Services Advanced Options Adviser Options Trading Wire Options Articles Breaking News Call Or Put Options?

Stock Options Trading Technical Analysis The Spread Trader Unusual Options Trading Activity Free Sign-Up Contact Us Member Log-In. About the Author Author Profile. Volatility Skew Implied Volatility Why Is Volatility Important? Stay Away From This Volatility Play Market Volatility And The Fed: What Are People Thinking?

Subscribe If you enjoyed this article, subscribe to receive more just like it.

We never share your info. Leave a Reply Click here to cancel reply. FOLLOW OPTIONS TRADING RESEARCH. FREE SPECIAL OPTIONS REPORT Free Report! MEMBER LOGIN Username or Email Password Forgot Password?

Implied Volatility Skew & Three Things it Can Tell YouREAL-TIME STOCK AND OPTION QUOTES… Get Stock Quote: Options Trading Research About Us Our Experts Premium Newsletters Contact Us Whitelist Us Terms of Use Privacy Policy Advertise With Us. Turn Wall Street Into Your Personal Cash Machine!

Options Categories Options Trading Options Trading Strategies Options Trading Basics Unusual Options Trading Activity Stock Options Trading Covered Call Writing Investing in Options Online Options Trading. Follow Us Online Connect with Us on Facebook Follow Us on Twitter. Page last updated