Is it worth buying fannie mae stock

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. FNMA can be a tempting stock for investors. Trading at just a fraction of its pre-crisis value, it has a lot of potential for a big payday if things go the right way. However, that's a pretty big "if" at this point. Before you consider investing in Fannie Mae, here's what you need to know.

Know why Fannie Mae is so cheap At first glance, it may seem strange that a profitable company trades so cheaply. Unfortunately, when something sounds too good to be true, it probably is. The reason for the cheap price is that as of now , shareholders aren't entitled to any of the company's earnings. Treasury as repayment for the bailout it received in Additionally, there has been an ongoing effort in Congress to completely dismantle Fannie Mae.

So far no one has been able to agree on much, but if Fannie Mae were shut down, shareholders could be completely wiped out. Investors are making a good case A lot of Fannie Mae's shareholders, led by activist investors such as Bill Ackman and Bruce Berkowitz, are challenging the current arrangement, calling it an illegal seizure of profits that should belong to the shareholders.

Fannie Mae - Wikipedia

And they make a pretty good case. However, the money is being counted as "dividends," so the original debt is still outstanding and will remain so indefinitely. Secondly, there's the argument that if the government didn't want investors to have the potential for profit, why would it allow Fannie Mae's shares to continue to trade? Many of Fannie Mae's investors took a chance and bought shares when the company was left for dead. Now that Fannie is profitable again, shouldn't investors get a share of the profits?

Finally, there's a good case to be made that Fannie Mae would be worth much more if it were taken out of conservatorship and allowed to rebuild its capital levels.

Therefore letting shareholders make some money could be a win-win situation. This will most likely be a drawn-out, uphill battle that could take years to work its way through the court system, and there's no guarantee that the outcome will be in favor of shareholders.

In fact, one judge already dismissed a handful of the lawsuits. And, while there are still some lawsuits pending in front of a different judge, using somewhat different arguments, there's a strong possibility that the outcome will be the same. An investment in Fannie Mae might make sense from a pure risk-reward standpoint. After all, the current share price is about one-tenth of the low estimate of what shares could potentially be worth. And although the odds of a favorable outcome for shareholders aren't very high, I certainly believe there's greater than a one-in-ten chance.

However, an investment like this is only appropriate for certain people. First of all, before you decide to invest in Fannie Mae, you need to fully understand all of the risks involved -- and the purpose of this article is to help you realize that. There's a distinct possibility that your investment could end up being worthless, so you should not make this investment with money you're not willing to lose.

If you believe in Fannie Mae, there's nothing wrong with making a small, speculative investment if you fully understand what you're getting into. Just realize that investing in Fannie Mae isn't much different from taking your money to a casino; the odds just might be slightly in your favor. Matthew Frankel has no position in any stocks mentioned.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. Matt brought his love of teaching and investing to the Fool in in order to help people invest better.

Matt specializes in writing about the best opportunities in bank stocks, REITs, and personal finance, but loves any investment at the right price. Follow me on Twitter to keep up with all of the best financial coverage!

Skip to main content The Motley Fool Fool.

Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Stocks Premium Services.

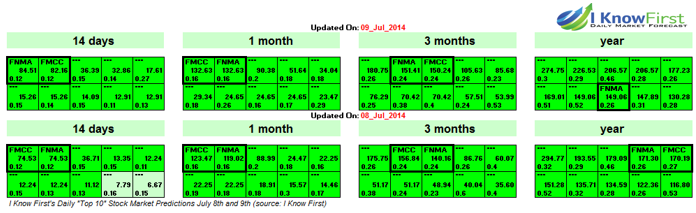

Future Fannie Mae And Freddie Mac Grow Brighter Into - Fannie Mae (OTCMKTS:FNMA) | Seeking Alpha

Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks.

Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep?

Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Mar 22, at Prev 1 2 3 4 Next. Motley Fool push notifications are finally here Allow push notifications to help you stay on top of Breaking investing news Earnings coverage Market movers Special offers and more Subscribe to notifications You can unsubscribe at any time.